Payment Saver Auto Loan

Up to 40% lower monthly payments than conventional auto loans!

Our Payment Saver Auto Loan Program is designed to get you behind the wheel with a payment you can afford without all the heavy restrictions and hidden costs of leasing.

What is a Payment Saver Auto Loan?

The Payment Saver Auto Loan is similar to a lease, but you actually own the vehicle. When your term is up you can decide between refinancing the remaining balance and keeping your vehicle or returning it.

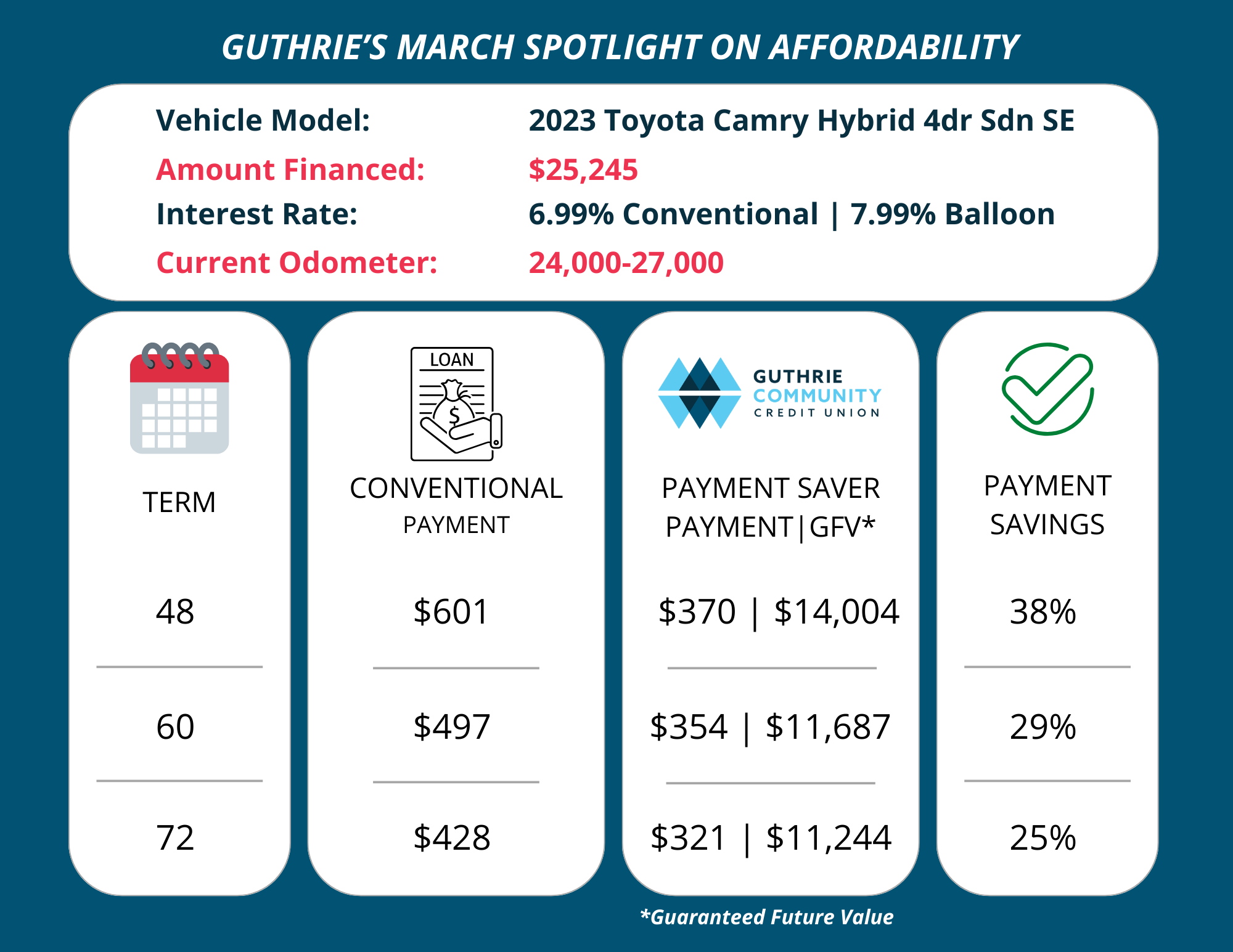

See Our March Spotlight to Learn How Much You Can Potentially Save!

How does the Payment Saver Auto Loan Program Work?

- Eligible Vehicles: Future year, current year, and used vehicles up to five years old.

- Financing Terms: 24 to 72 months.

- Residual Value: Established based on the term of the loan using industry approved guidelines similar to leasing.

- Payments: The difference between what you pay for the vehicle and the residual value is used to determine the principal portion of your payment, which results in a lower monthly payment than conventional financing.

- Options: At any time during your loan term, you can choose to sell the vehicle and pay the loan balance (including residual value) and keep any difference, use the vehicle as a trade-in and the loan balance (including residual value) is paid as part of the transaction, keep the vehicle and refinance the loan balance (including residual value) as a used vehicle loan, or at loan maturity return the vehicle and “walk away” from the residual value.

Payment Saver Auto Loan Benefits

- Up to 40% lower payments than conventional auto loans

- You OWN the vehicle

- Financing Available for up to 125% of vehicle value

- Available for new or used vehicles (up to 5 model years old)

- No down payment required

- Flexible terms from 24-72 months

- Annual mileage options of 12,000, 15,000 and 18,000

- No early payoff penalty

- No high insurance premiums

- At the end of your term, turn in your vehicle and walk away, or refinance the balance and keep it

- Easily upgrade your vehicle every few years

- Refinance your current auto loan from another lender to reduce your monthly payment with a Payment Saver Auto Loan