Debt can be a heavy burden. For many Americans, credit card debt significantly contributes to financial stress. High-interest rates on credit cards can make it challenging to make substantial progress in paying down balances. Fortunately, various debt consolidation options can help ease the financial strain and expedite the journey to becoming debt-free. This article will explore different debt consolidation methods, such as personal loans, home equity loans, and fixed lower-rate credit cards. We will delve into the advantages of each, comparing their benefits to the current average credit card rate in America, and illustrate how choosing a suitable consolidation method can lead to faster debt repayment and substantial savings.

Fixed Low-Rate Credit Cards

The average credit card rates in America are over 20%, and store credit cards are even higher. Fixed low-rate credit cards are specifically designed to offer a stable, lower interest rate than traditional credit cards. While less common than their variable-rate counterparts, these cards can be an excellent option for consolidating high-interest debt. Best of all, the fixed rate provides predictability. Guthrie Community Credit Union offers a balance transfer credit card promotion featuring 0% APR* for 12 months and fixed low rates after the intro period expires. Plus, there are no annual or balance transfer fees. It can be a great way to consolidate and pay off high-interest debt sooner and for less. Click here to learn more.

Personal Loans for Debt Consolidation

Personal loans have become popular for debt consolidation due to their fixed interest rates and structured repayment plans. These loans typically offer lower interest rates than credit cards, providing a significant advantage for those seeking to escape the cycle of high-interest debt. Transitioning from multiple credit card payments to a single personal loan payment can simplify financial management and reduce the risk of missed payments.

One of the primary benefits of personal loans is their predictability. Borrowers receive a fixed interest rate for the duration of the loan, which means their monthly payments remain constant. This stability contrasts sharply with the fluctuating rates of credit cards, allowing individuals to budget more effectively and plan for debt repayment with confidence. Guthrie Community Credit Union Personal Loans are a great option for consolidating high-rate debt balances.

Using Home Equity Loans to Consolidate Debt

Homeowners may consider leveraging their home equity through a home equity loan for debt consolidation. These loans are secured by the home’s value, leading to lower interest rates than unsecured options like personal loans or credit cards. Home equity loans provide the dual advantage of lower interest rates and potential tax benefits, as the interest paid may be tax-deductible.

While home equity loans can be an effective debt consolidation tool, carefully weighing the risks is crucial. Defaulting on a home equity loan can result in losing one’s home, making this option more suitable for those with a stable financial situation and a commitment to responsible financial management. Click here for information on the home equity loan options at Guthrie CCU. There are convenient terms to fit your individual needs.

Comparing Rates

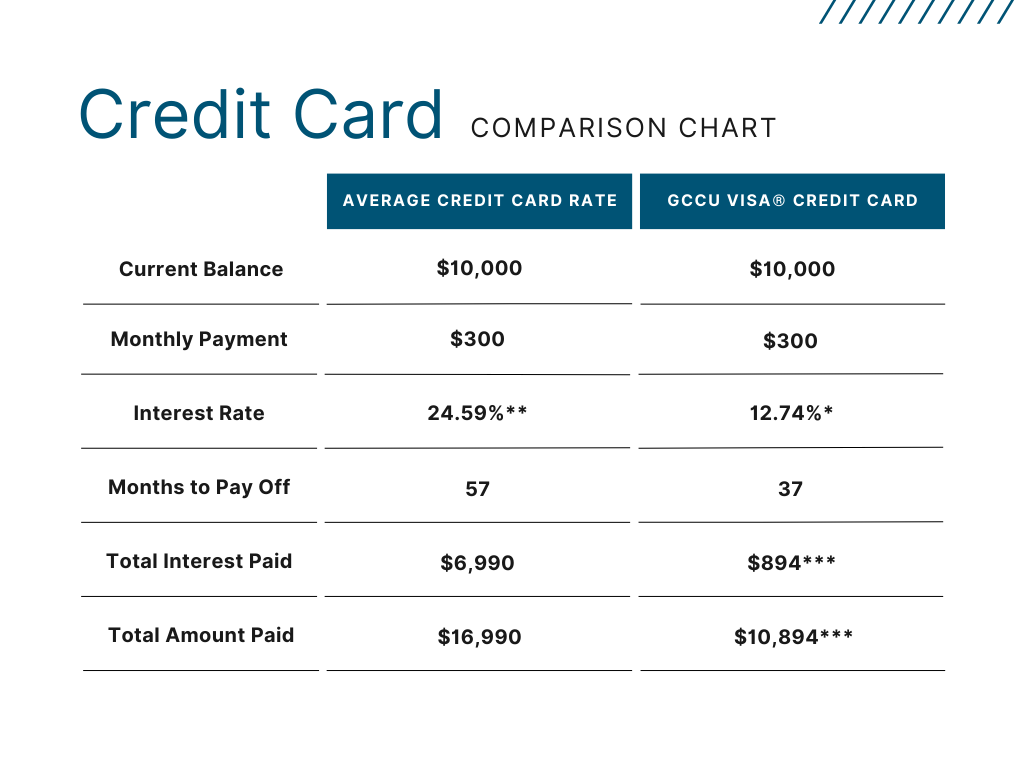

Take a look at the comparison chart below using the average credit card rate in America as of 1/5/2024 and Guthrie’s current VISA® Balance Transfer Credit Card promotion. In this example, the consumer was able to pay their balance down to $6,400 during the 12-month 0% APR* period, only paying $894*** in interest over the next 25 months while paying off the remainder of their debt. This is compared to paying $6,990 in interest over 57 months without transferring the balance to Guthrie. Click here to learn more and start your journey toward financial freedom!

Choose Debt Consolidation Options Wisely

Exploring different debt consolidation options is crucial for those burdened by high-interest credit card debt. Personal loans, home equity loans, and fixed low-rate credit cards offer unique advantages, allowing individuals to choose an alternative that best aligns with their financial goals and circumstances. By taking advantage of lower interest rates and predictable repayment plans, individuals can expedite their journey to financial freedom, reduce stress, and ultimately save money. Transitioning from high-rate credit cards to a consolidation option is not just a financial decision; it’s a strategic move toward a more stable and secure financial future.

* Certain restrictions apply. Membership eligibility is required. APR = Annual Percentage Rate. Approval is subject to current lending guidelines and credit qualifications. The APR of 0.00% is a “Discounted Rate” for 12 months. After expiration of the “Discounted Rate” the remaining unpaid portion will be subject to your normal APR as outlined on your monthly credit card statement. No annual fee. No transfer fee. Cannot be combined with other offers. You may not pay off any other GFCU loan product using this “Discounted Rate”. All terms, including the APR are subject to change at any time, for any reason, in accordance with the Credit Card Agreement and applicable law. Subject to available credit. Guthrie Federal Credit Union reserves the right to withdraw this offer at any time.

** High-interest credit card information gathered from lendingtree.com as of January 5, 2024, and subject to change. Credit cards offered by other institutions may have different rates and terms.

*** Only have to pay interest on $6,400 because Guthrie Community Credit Union offers the first 12 months at 0% APR, so with $300 monthly payments, the balance is reduced by $3,600 in the first 12 months to $6,400.